Every buyer is better off having some kind of representation, an experienced agent is best, or at least an attorney to review the contract and point out your risks and obligations. Buying new construction without representation could be a big mistake.

Whether you can negotiate or not is dependent on the market conditions at the time you’re purchasing. Over the years we’ve been able to negotiate different elements of a builder contract to benefit our buyer clients.

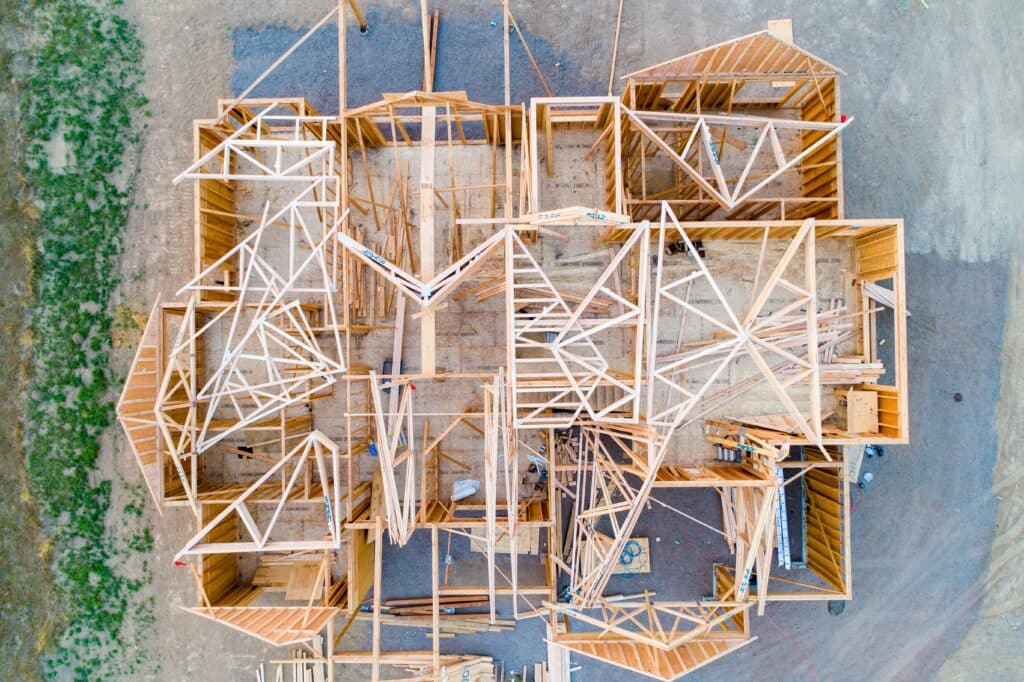

Buying New Construction In Northern VA – What to Know

During the past couple years, we couldn’t get much, the best items to negotiate have been around the design choices and getting upgrades. The builder’s goal is to show the highest purchase price possible, they aren’t required to show credits or upgrade costs in tax records or the MLS, so these are the places that you may be able to negotiate, even in a hot market.

BEWARE: Builders will usually offer incentives if you use their lender and their settlement companies. They aren’t doing you any favors. The builders own a piece of both companies and they’re making more profit than they’re giving you.

Keep in mind that everything the builder and the builders agents do and suggest are for their benefit. They will never do you any favors or offer you any incentive if it doesn’t benefit them in some way.

What to Look For

Here’s a list of specific items we always look for in a builder contract and try to negotiate – keep in mind some of these are location specific, so would vary depending on specific market:

- 3rd party independent inspections at pre-drywall phase, and prior to builders pre-settlement walkthrough, usually you’ll need another walkthrough prior to settlement because 3rd party inspectors always find something.

- The terms should be broad enough that you can get any kind of inspection you want; general, electrical, plumbing, sewer scope, HVAC, etc

- Concessions that are tied to using the builders title company and lender – get the credit even if you want to use your own partners. Title company especially, they’re usually non-meticulous entities that the builder partially owns and will rarely want to act in the buyer’s best interest.

- Sales taxes – in our area the seller usually pays their own transfer taxes, but builders usually try to make the buyer pay them. Check into what’s normal in your area and see if the builder is trying to get you to pay expenses that are usually paid by the seller.

- Warranties – In my state there’s a law about builder warranties, most builder contracts specifically state “builder is not obligated to follow state law” when it comes to warranties. It may not be a big deal if they offer an adequate warranty, but most consumers don’t know the difference and don’t realize they’re signing away their ability to leverage the state laws.

- Indemnifications – Many builder contracts in our area (especially the smaller builders) usually have some kind of caveat that says “if a dispute is less than $10,000 the buyer promises not to hire their own attorney” which is BS if you ask us, but most consumers think it’s reasonable.

More Contract Terms to Know

Other contract terms that are common in builder contracts; it’s always important to read the entire contract and pay attention to the details:

- 2 years to build the property, with no consequences for missing deadlines.

- Design choices and builders ability to switch out materials without buyer approval – sometimes they have to make changes due to supply issues, but the buyer should be able to approve before the swap is made.

- No contingencies – no appraisal, financing or other type of contingencies. No contingencies is high risk for buyers.

- Consequences for buyer delays – often there’s a ridiculous daily rate levied against the buyer for any delays, but not consequence for seller delays.

- Consequences for builder delays – without contingencies, the buyer is left to bear any expenses for the builders delay. Ideally, a buyer should be able to negotiate rate lock extensions paid for by the builder, if the delay is the builders fault.

Buying New Construction With Professional Representation

IF YOU CHOOSE TO HIRE AN AGENT – make sure they’re experienced with new construction and have success negotiating contract terms with builders. A lot of agents will register as your agent w/the builder and then do nothing, or if you have questions will suggest you talk to the builder rep. That’s not adequate representation.

READ THE CONTRACT CAREFULLY BEFORE SIGNING. The contracts are dense and difficult to decipher with all the silly additional legalese.

Every buyer is better off by having some kind of representation, an experienced agent is best or at least an attorney to review the contract and point out your risks and obligations.

If you’re considering buying new construction in Northern Va, please contact us. We can help you through the entire process so your interests are protected. Please click here for our contact page.